I’d like to take a brief break from geeking out over fiction to share an anecdote about when I geeked out over refinance paperwork. Perhaps scam would a harsh term, maybe even unfair (I very well could be missing something here). But to this non-expert, paying attention just saved us from losing a bunch of money and reinforced the importance of reading before signing anything.

Back in the fall, my husband and I had the opportunity to refinance our mortgage to take advantage of lower interest rates. We looked at the numbers, and determined that refinancing would actually save us money, so we started the process.

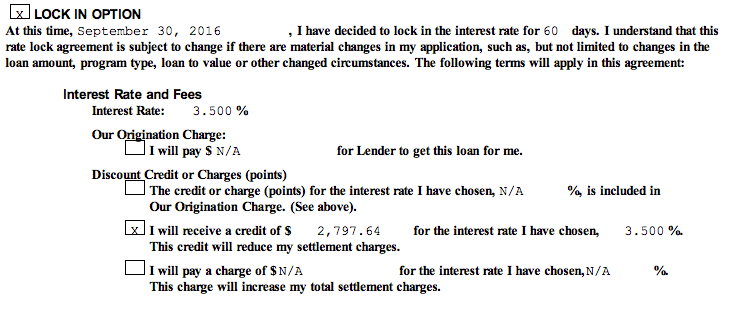

We filled out the online paperwork, signed digitally, and locked in our rate (including getting some money back). Here are the terms we signed to lock in the rate while the paperwork processed.

To clarify, we signed this document to secure a mortgage rate of 3.5% interest, and would also get over $2,700 credit for doing so. The rate needs to be locked in so that even if interest rates fluctuate while we wait for the paperwork to process, we and the bank agree to proceed with that particular rate.

So we signed. And then we waited. We had to schedule an appraisal and wait for the results, then wait for underwriting to do its thing. Legalese, legalese, paperwork, wait. And in that time, the lock-in date came and went, which meant that to continue processing the refinance, we had to sign an updated agreement (with the date pushed back) to extend the terms.

This time, you’ll notice, the rate is the same but the now the credit we’d receive was considerably lower. I believe the explanation about why was something about how the date for our escrow needing to be used to pay out our taxes was approaching, something something, I don’t remember now. Anyhow, while the payout was much lower, the numbers still seemed to tell us to proceed. So we signed to lock in the date for another month.

And again, the lock-in date came and went. This time, when we were sent updated documents, we were told that the taxes did need to be paid out, and that the escrow didn’t have enough money to cover it, and that we would have to pay some money to cover that, but that somehow it would still benefit us to sign. Because 3.5% is a great interest rate.

Except, math. Looking side by side at the numbers, we went from getting $2,700 by refinancing to owing $6,700 cash. According to math, the refinance would cost us $10,000. And while Math is hardly a dashing spandex-wearing flying superhero, he’s certainly a hero in our book.

Regardless of the tax situation, signing that document the third time did not make sense.

We walked away. And I’m glad that I kept screen shots of the terms. I’m not looking to call out any lenders, and I’m not certain if this was the result of bureaucratic inefficiency, the timing of tax payments, or nefarious plotting by some evil super villain, but either way, I’m glad Math and Reading (and a little bit of Critical Thinking) were on our side. If the purpose of refinancing was to save money long term and add a little money to our pockets along the way, then this was not the way to accomplish that.

I would suspect that interest rates were steadily rising, so they choose to not complete your paperwork so they wouldn’t have to absorb the costs associated with your lock-in.

i.e. They would have lost $2000 on that first 2 months, so they just stalled and got you to agree to pay the higher rate / points.

Depending on what your interest rate is isn’t there a possibility that this still could have been a good deal? I understand as the dollar amount offered goes down it gets worse than it used to be, but if your starting interest rate is high enough and the dollar amount owed is high enough the reduction in interest paid over the life of the loan could be big enough to make this a good deal. I’m guessing that it’s not , But I don’t think there’s enough information in your article to tell if this is a good or bad deal.

I fail to see the issue. You either refinance or dont. If it is the lender that held up the process then lean on them to extend the lock. But if you fail to get the paperwork done or are slow in getting thing needed to fund then you have failed. It sounds to me that the person writing this article doesn’t understand how mortgages or rates work.

That’s typical in a rising rate environment. And rates rose pretty fast at the end of 2016; I actually purchased right around that time. Not sure why the paperwork couldn’t be completed on time, but as rates were rising quickly, of course you could have still received your $2700 credit, at a higher mortgage rate.

Easy guys. They made the effort, read the fine print, proceeded until it became something they did not like, or expect, and reneged.

Seems to me that’s prudent, and not like most catastrophes we read about.

Cheers to SKG!

You got ripped off cause you did it online. Go into a bank and talk to an actual MLO.

You got ripped off cause you did it online. Go into a bank and talk to an actual MLO. Doesn’t matter what bank any of the 5 major can help